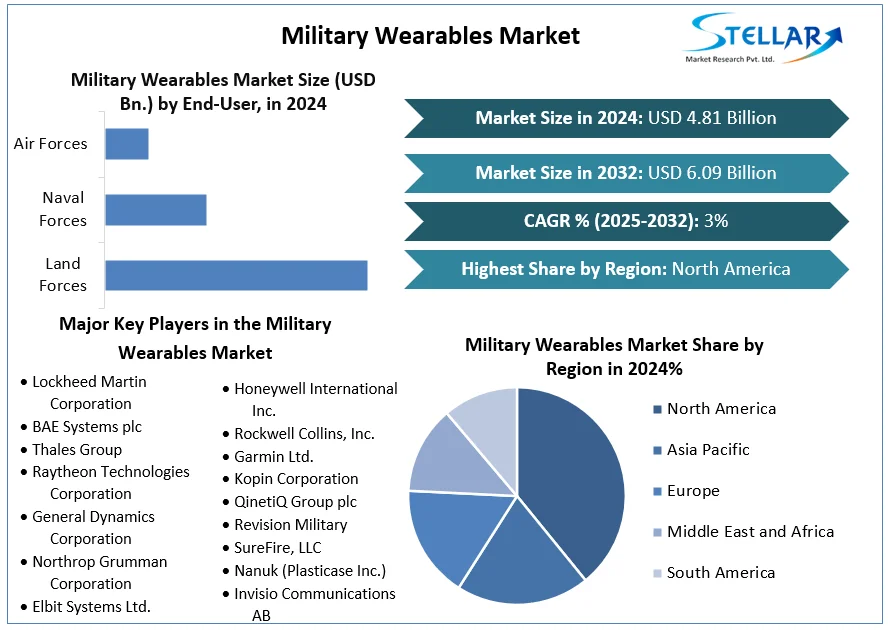

Military Wearables Market, valued at approximately USD 4.81 billion in 2024, is projected to grow to around USD 6.09 billion by 2032, achieving a CAGR of roughly 3% between 2025 and 2032 ([turn0search0]).

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Military-Wearables-Market/1974

Market Estimation, Growth Drivers & Opportunities

Based on Stellar Market Research data, the market in 2024 stood at USD 4.81 billion and is expected to reach USD 6.09 billion by 2032, reflecting a 3% CAGR ([turn0search0]). Other estimates suggest slightly higher growth—TechSci Research forecast from USD 4.70 billion in 2023 to USD 5.76 billion by 2029 at a CAGR of 3.48% ([turn0search11][turn0search8]), while Straits Research projects USD 5.69 billion by 2033 from a 2024 base of USD 4.44 billion at 2.8% CAGR ([turn0search4]).

Key drivers include:

-

Rising defense modernization and increased defense budgets, funding investments in soldier systems and smart gear.

-

Integration of AI, augmented reality (AR), smart textiles, and sensor systems, providing real-time situational awareness, biometric monitoring, and communications support ([turn0search3][turn0search11][turn0search8]).

-

Growing adoption of exoskeletons and ergonomic bodywear to reduce soldier fatigue and enhance mobility ([turn0search11][turn0search3]).

-

Escalating demands for health monitoring, navigation, and networked battlefield systems, particularly in asymmetric warfare theaters ([turn0search3][turn0search5][turn0search11]).

Opportunities reside in developing modular AR helmets, secure networked wearables, battery-efficient smart textiles, and integrating wearables into broader battlefield IoT systems.

U.S. Market: Latest Trends & Investment

North America, especially the U.S., remains the largest regional market, projected to grow fastest by 2030 to more than USD 2.26 billion ([turn0search2][turn0search5][turn0search10]).

Recent developments include:

-

Meta Platforms partnered with Anduril Industries to launch EagleEye, a high-tech AR helmet system powered by Meta’s AI models and Anduril’s autonomy software. This privately funded initiative aims at a $100M U.S. Army wearables contract within a wider $22B program ([turn0news13][turn0news12]).

-

BAE Systems secured a £133M contract with the Eurofighter consortium to advance its Striker II Helmet Mounted Display, which integrates AR, night vision, and pilot data ([turn0search5]).

-

Viasat, in collaboration with USSOCOM, introduced the Secure Wireless Hub, a lightweight wearable communications system offering secure battlefield connectivity under 1 kg ([turn0search5]).

These initiatives highlight the U.S. military’s emphasis on merging commercial tech with defense-grade wearables.

Market Segmentation: Segment with Largest Share

-

By End-User:

-

Land Forces dominate the market, representing the largest and fastest-growing end-user segment—driven by demand for AR eyewear, exoskeletons, biomeasure monitoring, and wearable communications ([turn0search11][turn0search3]).

-

-

By Region:

-

North America leads market share in 2024. Asia-Pacific is the fastest-growing regional market, while Europe shows rising growth momentum ([turn0search11][turn0search2][turn0search4]).

-

-

By Technology/Wearable Type:

-

Diverse categories include headwear (helmets, HMDs), eyewear (AR glasses), bodywear/exoskeletons, wristwear, smart textiles, and integrated communication systems; head- and body-worn systems remain central in defense procurement ([turn0search4][turn0search10]).

-

Competitive Analysis: Top 5 Companies

Key industry leaders include:

BAE Systems plc – Developer of the Striker II Helmet Mounted Display, with recent multi‑million-pound contracts supporting Eurofighter jet pilots ([turn0search5]).

Elbit Systems Ltd. – Major provider of integrated AR headgear, soldier systems, and ISR platforms. Known for innovation in rugged sensor and helmet displays.

General Dynamics Corporation – Supplies body-worn communication systems and networked wearable modules for U.S. and allied forces.

Rheinmetall AG – European defense technology firm expanding into smart helmets, wearable sensors, and exoskeletons for land forces.

Thales Group – Partnered with France’s Ministry of Armed Forces in 2024 to deploy connected helmets and body‑worn sensors in next-gen combat systems ([turn0search5]).

Other noteworthy players: Honeywell, L3Harris Technologies, Northrop Grumman, Lockheed Martin, and Safran Electronics & Defense, each integrating wearables into broader mission suites ([turn0search4][turn0search5]).

Regional Analysis: USA, Europe, Asia-Pacific

-

United States (North America): Dominates global market share in 2024, driven by early adoption of AR/AI wearables, funded defense modernization programs, and strong domestic demand ([turn0search3][turn0search2]).

-

Europe: Fastest regional growth in Straits Research estimate ([turn0search4]). Countries like UK, France, Germany, and Italy are investing in AR helmet systems, integrated sensors, and secure command-and-control wearables via key programs ([turn0search5]).

-

Asia-Pacific: Generated USD 1.064 billion in 2024, expected to reach USD 1.282 billion by 2030 at a CAGR of 3.1%. Growth strongest in China and India, with land forces leading adoption ([turn0search2]).

Additional growth potential is seen in Middle East, Latin America, and Africa as defense modernization drives regional procurement of soldier-wearable systems.

Conclusion

The Military Wearables Market is on track to expand from USD 4.81 billion in 2024 to USD 6.09 billion by 2032, growing at about 3% per year ([turn0search0][turn0search4][turn0search3]). Despite conservative estimates, macro-trends signal accelerating investment in AR helmet systems, smart textiles, exoskeletons, and connected soldier systems.

Major growth opportunities include:

-

Broad commercial adoption of AI-augmented wearable helmet displays, such as Meta–Anduril’s EagleEye and BAE’s Striker II.

-

Expansion in wrist- or body-worn health monitoring devices for biometric situational awareness and training optimization.

-

Integration of smart textiles and exoskeletons to improve mobility, reduce injury risk, and extend mission duration.

-

Development of secure communication modules and wearable networking hubs for dismounted forces.

-

Leveraging private capital and venture-backed innovation in defense tech, accelerating modular wearable development.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

sales@stellarmr.com